IREDA - Renewable Renaissance

Dump of all the information which could be collected under the sun

Welcome, readers! 🌟 Dive into this comprehensive blog post where we unravel the intricacies surrounding IREDA, India's foremost player in financing renewable energy projects. From its pioneering business model to the risks and growth prospects, I've compiled all you need to know about this dynamic company shaping India's sustainable future. Let's embark on this enlightening journey together! 🚀

IREDA, is a non banking financing company which provides financial assistance to renewable energy projects like power generation, equipment supply and fuel source projects including wind power, solar power, hydro power, biomass.

The Company’s primary sources of funds include domestic and foreign borrowings, internal resources and Government of India support.

Business model

In 1987, the Indian government established IREDA, a key player in financing renewable energy projects across India. Over the years, it has evolved into the country's largest provider of such financing, disbursing loans amounting to nearly 50,000 crores.

IREDA's business model, though straightforward, is often misunderstood. Essentially, they acquire loans at a low-interest rate of 6.23% and then channel these funds towards large-scale renewable energy initiatives, charging an average interest rate of around 10%. This setup allows them to pocket a tidy profit margin of 4% on every loan they extend.

This model benefits not only IREDA but also the companies receiving the loans. With a 10% interest rate, these companies enjoy a much more favorable borrowing cost compared to alternative sources. It's a win-win situation.

While some may be apprehensive about IREDA's significant debt, it's important to recognize that in the realm of finance companies, debt is a fundamental tool for generating revenue. For entities like IREDA, more debt translates to more lending capacity and, consequently, more earnings.

What sets IREDA apart is its remarkably low borrowing rate, which stands out even among its peers. Half of their funding comes from domestic sources such as the RBI and bonds, while the other half is sourced from foreign green investors, including prestigious institutions like the Japan International Cooperation Agency and the World Bank. In 2023, IREDA's average cost of borrowing was an impressively low 6.23%, significantly lower than that of similar institutions like REC Limited and Power Finance Corporation Limited.

Additionally, IREDA enjoys a dominant position in the renewable energy financing sector, commanding a substantial 30% market share. As a government nodal agency, it plays a crucial role in implementing various subsidy schemes, providing an invaluable competitive edge to the companies it supports.

IREDA's workforce is another strength, comprising highly skilled professionals from the country's leading management schools. Their expertise in project finance underpins the company's ability to assess and underwrite ventures effectively.

Furthermore, the competitive landscape in this sector is evolving in IREDA's favor. Major banks like HDFC, SBI, and ICICI are increasingly scaling back their involvement in project finance, redirecting their focus toward other areas. This strategic shift has created a less crowded field for IREDA to operate in, further solidifying its position as a key player in renewable energy financing.

In essence, IREDA's business model thrives on leveraging low-cost debt to fuel the growth of renewable energy projects in India. With its strategic advantages, competent workforce, and favorable industry dynamics, IREDA continues to drive sustainable development while delivering attractive returns for its stakeholders.

Strengths

Customer Stability and Profit Assurance:

Majority of IREDA's clients, comprising large solar and wind energy projects, have long-term Power Purchase Agreements (PPA) with the government, ensuring a fixed price for the electricity they generate.

These PPAs, established to incentivize renewable energy investments, provide a stable revenue stream for companies regardless of when they commenced operations.

In one off cases, legal precedent, exemplified by the Andhra Pradesh High Court ruling, reinforces the sanctity of these agreements, bolstering profit predictability.

Risk Mitigation Strategies:

Over 93% of IREDA's loans are backed by collateral, offering a safeguard in case of default.

Nearly all loan recipients (99.6%) are required to obtain insurance against natural disasters, shielding against unforeseen calamities.

The majority (94.3%) of loans are structured with floating interest rates, linked to inflation, mitigating inflationary risks for IREDA.

Diversified Portfolio and Political Stability:

IREDA's loans are distributed across 23 states, dispersing political risk geographically.

The top 20 borrowers account for 40% of total loans, ensuring a diversified portfolio.

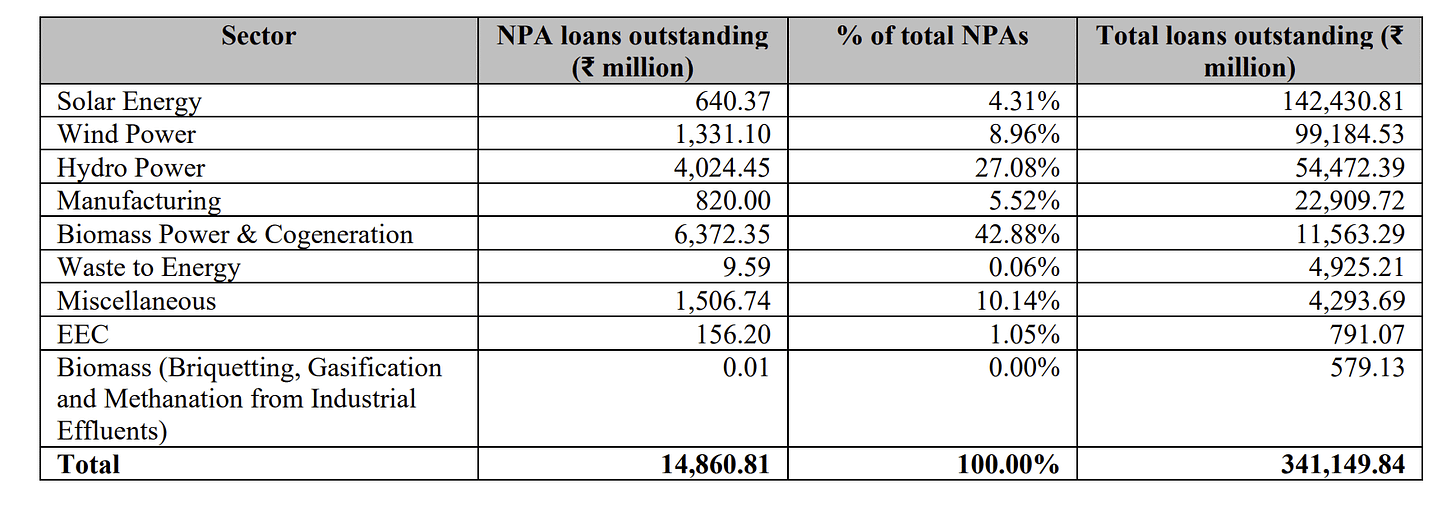

Non-Performing Assets (NPAs) Management:

Despite potential risks, only 1.66% of loans have turned into NPAs.

Majority of NPAs stem from loans to biomass and hydro plants, considered learning experiences.

With solar and wind energy projects driving future growth, NPAs are anticipated to decline further.

MOAT?

Unique Value Proposition:

Unlike typical government-owned enterprises with massive market capitalizations, IREDA stands out with a relatively modest market cap of 15k, presenting an opportunity akin to a government startup poised for substantial growth.

Simplified Operations: With only 175 employees boasting an average experience of 18 years, IREDA operates efficiently with a focused business model, in contrast to larger and more complex government projects handled by entities like HAL (Jets) or Mazagon (ships).

Streamlined Customer Base: Unlike other government entities burdened with numerous customers, IREDA manages a lean customer portfolio, enabling it to provide superior service and maintain operational efficiency.

Financial Strength and Growth Potential:

Government mandates for dividends ensure consistent returns, with IREDA historically profitable and poised to offer lucrative dividends in the future. So, new guidelines says all central public sector enterprise are required to pay a minimum annual dividend of 30% of profit after tax or 5% of the net worth

Market Perception and Growth Prospects: Despite a modest net worth, IREDA's market capitalization of 15k crores indicates significant growth potential, especially considering India's ambitious renewable energy targets and the company's pivotal role in financing renewable projects.

Government Support: Direct government infusion of funds, exemplified by Prime Minister Modi's recent injection of 1500 crores, underscores strong governmental backing for IREDA's growth trajectory.

Continued Government Ownership: Post-IPO, the government retains a 75% stake in IREDA, signaling a steadfast commitment to the company's expansion.

Assets and Revenue Streams:

Besides its financing activities, IREDA boasts ownership of a lucrative 50MW solar power plant in Kerala, generating substantial annual revenue of 28 crores.

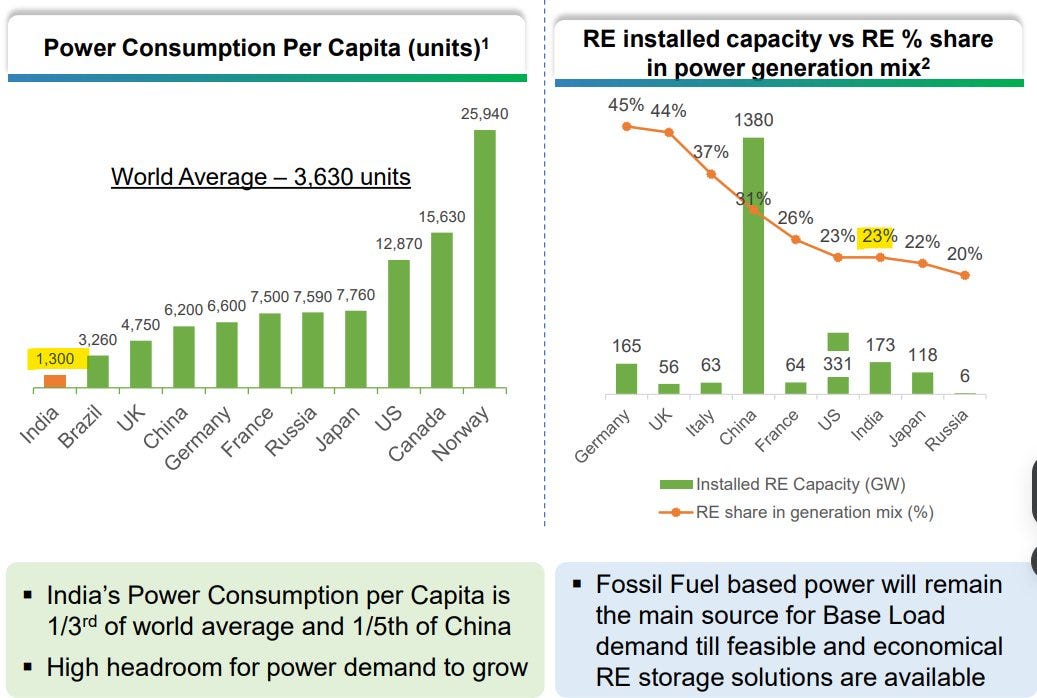

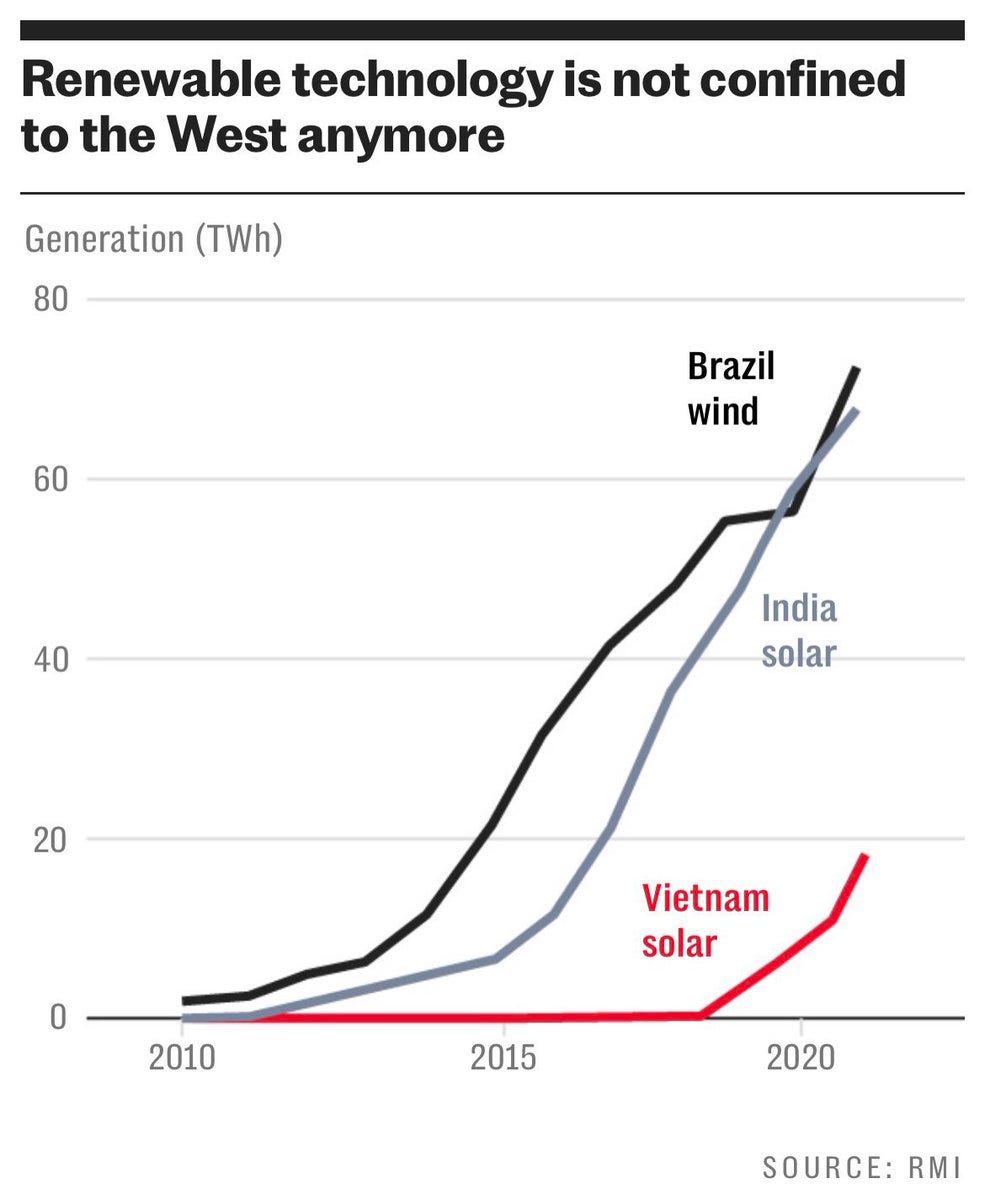

India aims to achieve 500 GW of renewable energy by 2030, a substantial endeavor given its current total energy consumption of around 190 GW.

Solar energy capacity in India has grown exponentially, increasing by 30 times in the past nine years to reach 70.10 GW as of July 2023.

IREDA has financed 22 GW of renewable energy projects in India, including the largest solar power plant globally, demonstrating its pivotal role in advancing renewable energy infrastructure.

OPPORTUNITIES

Potential for Growth:

IREDA possesses significant growth potential over the next six years, with ample room for expansion.

Even at five times the IPO price, the company's market capitalization would remain below 100k crores, presenting an opportunity for substantial appreciation.

Given the forward-looking nature of the stock market, large funds may anticipate and invest in IREDA well before its actual value reaches such heights, exerting considerable influence on its trajectory.

Scalable and Low-Risk Business Model:

IREDA operates a highly scalable, data-driven business model with minimal lending risk.

Predictable costs and returns in renewable energy projects, such as solar panels, mitigate the likelihood of bad loans, unlike other financing sectors where risk factors vary widely.

RISKS

Stretched Valuation:

IREDA may face the risk of a stretched valuation, particularly if market expectations outpace the company's actual growth and performance.

Sector Concentration:

The company's lack of diversification, being fully focused on the renewable energy sector, exposes it to risks associated with fluctuations and challenges specific to that industry.

Government Company Risks: ( Unlikely)

Standard risks associated with government-owned entities, such as bureaucratic inefficiencies, regulatory changes, and political interference, may affect IREDA's operations and growth potential. This looks very low considering BJP in centre till 2029.

Risks arise from state governments refusing to honor higher premiums promised to older power plants, as seen in cases like Andhra Pradesh. While legal resolutions may favor the power plants, such disputes could create uncertainty and financial strain.

Interest Rate and Bad Loan Risks:

IREDA is vulnerable to interest rate fluctuations, which could impact its borrowing costs and profitability.

While the company's lending model generally entails low risk due to the predictability of returns in renewable energy projects, there remains a possibility of bad loans, albeit mitigated by data-driven assessments.

DISCOM Payment Delays:

Poor financial health of Distribution Companies (DISCOMs) in various states may result in delayed payments to renewable energy firms, potentially causing cash flow issues and legal disputes, thus jeopardizing loan repayments.

Security Threats During Conflict: (Unlikely)

In the event of a major conflict, solar power plants, particularly in vulnerable regions like Rajasthan, Gujarat, and Ladakh, could become targets for enemy attacks, leading to significant financial losses and disruption in energy production.

Technical Failures: (Highly unlikely)

Potential technical flaws or premature failures of solar panels or windmills could impact profitability, although most plants are designed to be financially viable within a ten-year timeframe.

Foreign Currency Exchange Risk: (Highly unlikely)

Half of IREDA's borrowing is in foreign currency, exposing the company to the risk of significant losses in the event of a sharp depreciation in the value of the Indian rupee against the dollar.

SECTOR Related Media

YouTube

Im Looking at :

Navratna status

The Focus on PM KUSUM & Rooftop Solar policies

Next quarter earnings and Bad Loans

Buying by MFs/FIIs

UPDATES

→On Navratna status: Meeting was successful and all criteria are met. Hopefully the process will complete soon. Looks like might get delayed due to Elections.

→On Retail division: PM Kusum scheme will provide solar power in agriculture. E-mobility (E-rickshaw and EV cars) financing will be done by funding NBFCs to reduce their cost of lending.

→ IREDA may get added in MSCI Index

→ IREDA added in MSCI Emerging Index (Summarised below)

MSCI Domestic Indexes:

Large-cap additions: Tata Motors, Macrotech Developers

Mid-cap additions: Punjab National Bank, Canara Bank**

Small-cap to mid-cap upgrades: BHEL, Persistent Systems, MRF, Suzlon Energy, Cummins India** Kirloskar, Embassy Office Park REIT**

MSCI Emerging Markets Small Cap Index:

Indian Renewable Energy Development Agency added

GMR Airports Infra moved to mid-cap

Deletions: Prestige Estates Project, Rail Vikas Nigam

MSCI India Domestic Large Cap Index:

Additions: Trent, Tata Consumer Products, Power Finance, REC, Tata Power, Macrotech Developers, Tata Motors

MSCI India Domestic Small Cap Index:

Additions: IREDA, Vedant Fashions, Honasa Consumer, Cello World, Swan Energy, Paisalo Digital, Rattanindia Power, ITD Cementation India, Jaiprakash Associates, KPI Green Energy

Deletions: Persistent Systems, Suzlon Energy, Cummins India Kirloskar, MRF, BHEL, Oberoi Realty, Solar Industries India, Prestige Estates Project, Oracle Financial Services Software, L&T Technology Services

As we draw the curtains on this exploration of IREDA's role in driving India's renewable energy revolution, it's evident that the company stands at the forefront of innovation and progress.

Remember, UPDATES section in this post will be regularly refreshed with the latest insights and developments, ensuring you stay informed about IREDA's performance, risks and other ongoing contributions to the renewable energy landscape.

Thank you for joining us on this enlightening journey, and we look forward to continued engagement as we navigate the exciting landscape of renewable energy together.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice. The analysis and insights presented are based on publicly available information, and while efforts have been made to ensure accuracy, we cannot guarantee the completeness or reliability of the information.

Investing in securities carries inherent risks. This post should not be relied upon as a substitute for independent research or consultation with a qualified financial advisor.

The author of this post and the platform on which it is published do not provide personalized investment recommendations or financial advisory services. Any investment or trading decisions you make based on the information provided in this post are solely at your own risk.

Neither the author nor the platform shall be held responsible or liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this post. Readers are encouraged to conduct their own due diligence and seek professional advice before making any investment decisions.

By accessing and reading this post, you acknowledge and agree to the terms and conditions outlined in this disclaimer.

Disclaimer : ‘Invested’ hence views may be biased

Sources:

Lots of twitter threads

News papers/YT

https://twitter.com/ZeeBusiness/status/1749667281825882613

https://twitter.com/sahil_vi/status/1737692762420789545

Reddit profile