Dear Readers,

Despite loud warnings of a global slowdown, inflation spirals, and fiscal doom — markets have done what they often do: climb the wall of worry.

US markets are at record highs, fuelled by the “One Big Beautiful Bill” and an AI-powered growth narrative.

The USD is wobbling, challenging its long-standing primacy — a trend even the regulator back home is watching closely.

Global equity indices are soaring in USD terms — but a simple switch to euros is otherwise.

Nifty hovers near highs, but signs of domestic slowdown are creeping in — from underwhelming auto sales to flat GST collections.

The July 9 tariff deadline looms. Whether this bullish calm holds or breaks depends on geopolitics, inflation, and market psychology. (With the US imposing 25% tariffs on auto imports, India has proposed its own set of retaliatory duties)

India’s forex reserves jumped $4.8 billion, reaching $702.78 billion as of June 27 — a major buffer for external shocks and currency volatility.India’s forex reserves jumped $4.8 billion, reaching $702.78 billion as of June 27 — a major buffer for external shocks and currency volatility

The market is moving sideways with no major news or events to push it strongly in any direction.

This Month

📈 Smallcaps led the charge, with the Smallcap 250 up 4%, followed by Nifty 50 at 3.4% and Midcap 150 at 3% then Nifty Next 50 at 2.6%.

Now, Lets deep dive ! ☕️

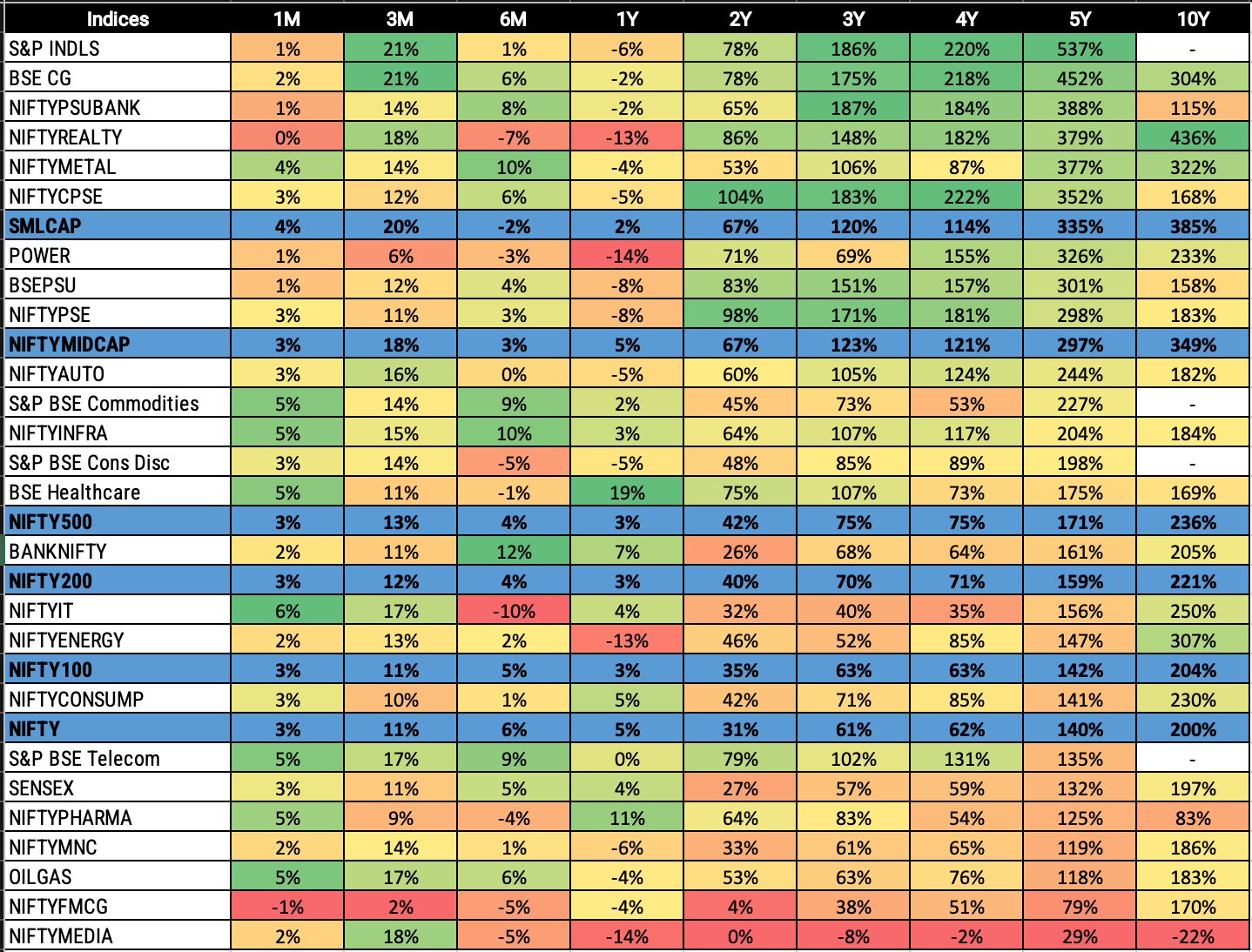

Returns on Indices across time periods

Returns across Sectors in June

This months trend tells a very different story: Capital Markets (+9%) and Consumer Durable (+5%) stole the spotlight, while Metals, Pharma and Logistics generated some alpha compared to Nifty. Broader indices like Nifty 50 and Nifty100 stayed positive, while FMCG was the eonly sector which struggled for momentum and stayed in red.

Nifty Smallcap100

NIFTY smallcap100 moved 600 points in a month moving towards All time high from the lows of Apr’25 (35%) . It is now above 50, 100 and 200 WEMA.

PE has now moved to 33.6 from 26.8 in Feb (lowest).

In last 1 month-Out of 100, 30 stocks have gained more than 5% in June whereas 41 gave negative returns. In last 1 year, 48 stocks gave more than 5% returns.

How to read this ?

For 5Y, returns are max for S&P Industrials at 607% (Greenest) and min for Nifty Media at 45% (Red). Similarly, one can check for each time period. The table is sorted by 5Y returns.

To continue reading, consider becoming a free or paid subscriber.

Keep reading with a 7-day free trial

Subscribe to The Curious Investor to keep reading this post and get 7 days of free access to the full post archives.