Overdiversification of your Mutual Fund Portfolio

The Art of Simplifying Your Investment Portfolio

Are you overwhelmed by the countless investment options available in the market?

Do you find yourself constantly chasing performance, only to end up with a cluttered portfolio?

Welcome, fellow finance enthusiasts, to a transformative journey towards adding another analytical perspective in your arsenal of managing your mutual fund portfolio.

In this post, we will delve into the world of mutual fund portfolios, uncovering the pitfalls of maintaining an overwhelming number of funds and exploring effective strategies to streamline your investments. This read might help you create a lean and efficient portfolio that not only simplifies management but also leads to more rewarding investments. So, grab your cup of coffee and join me as we embark on this educative exploration of personal finance.

The Price of Excess

Imagine having over 20 funds in your investment portfolio. It may seem like a diversified approach, but what if it could harm your returns? Experience reveals the common reasons behind accumulating an abundance of funds.

Chasing performance to the allure of excitement (Sort by 3Yrs),

Mis-sold investments (Chachaji/Mamaji ka), and the

Lock-in period of certain schemes (like ELSS),

However, there are three key reasons why having too many funds can be detrimental:

The challenge of managing- It would become difficult to manage 20-30 funds and one would observe

Funds with good performance

Funds with poor performance

Overlapping funds

Underallocated funds

Challenge in decision to add money in any of these funds.

The potential drag on returns- Lets say, A has 10 mutual funds in a 10 lac portfolio equally distributed with Rs 1 Lac in each of the funds and B has 4 funds in a 10 lac portfolio with Rs2.5 lacs in each fund. Assuming all the funds, for both A & B, give 10% returns except one which outperformed and gives 25% return. The overall returns drop significantly for A as compounding happens on the profit and as the amount invested was 1.5 lacs less, the returns get dragged. The drag also becomes sharp as the time increases.

The perils of over-diversification - 20 mutual fund across sectors would touch almost 450-500 stocks even after considering the overlap. These 500 stocks across these funds makes your fund comparable to index fund and subsequently returns also becomes index-like.

Additionally, one would be paying expenses of an active fund but getting returns of an index fund while indexes are comparatively cheaper as their expense ratio is less. One would probably invest in an active fund to get alpha (better returns than index) but investing in too many funds defeats the purpose.

For Example, three mutual funds, one each from large,mid and small cap segment, covers almost ~300 stocks with around 220 unique stocks.

The Power of Focus

The inherent concept and advantage of mutual funds itself is to provide diversification. Surprisingly, even one single fund can be sufficient for small portfolios. As in the above snapshot, one fund is spreading across 40 to 180 stocks.

As one’s investment corpus grows, achieving diversification is advisable with approximately 6-8-10 well-chosen funds.

The ideal composition of these funds can include large, mid, and small-cap funds, debt and gold schemes, thematic scheme and even an international fund. Debt and Gold funds give stability to the portfolio when markets correct and provide diversification over asset class. Whereas mid-cap and small cap can help in improving returns over a period of time while giving diversification across market segment. International funds can provide geographic diversification.

One shall focus on unlocking the potential of focused investing and discover how simplicity can lead to better performance.

Streamlining Your Portfolio

Now that we understand the benefits of a focused approach, let's dive into practical strategies for reducing the number of funds in your portfolio. We need to learn to evaluate the allocation and performance of each fund, bid farewell to under-performers, and consider switching to better-performing alternatives, even if it means incurring taxes on capital gains. One should focus on the key strategies to explore the art of optimization that will help achieve a streamlined and efficient investment portfolio.

Effective Strategies for Reducing Funds

Understanding Fund Allocation: Begin by examining the allocation of each fund in your portfolio. Determine how much of your total investment is allocated to each fund. Identify funds with a low allocation, especially those with less than 5%. These funds might no longer be contributing significantly to your portfolio's performance, making them potential candidates for exit or if they are performing better than those where allocation is higher, consider STP (switching) in this high performing fund. STP might attract capital gains tax so be aware of that.

As an illustration, consider the portfolio below. The portfolios highlighted in red represent less than 5% of the total. In such instances, I would need to assess their performance. If these portfolios are found to be underperforming, I would proceed to exit from them and redirect those funds to an alternative fund that displays strong performance, despite having a lower allocation. This process is facilitated through STP, if I intend to reallocate funds within the same fund house.

The numbers are randomly populated and the schemes are also sample and are just for illustration purposes.

Exiting Underperformers: Assess the performance of each fund over a reasonable timeframe. If a fund has consistently underperformed its peers for two or more years, consider exiting it. You can also check the Fund Rank in many apps like moneycontrol or Value Research to understand the performance of the Mutual Fund. Focus on funds that have delivered consistent returns over time, as indicated by their fund report card.

Comparing Redundant Funds: Many investors end up with multiple funds from the same category or fund house. Compare the performance of these redundant funds and consider retaining the one with better returns and prospects. Diversify across fund houses to reduce portfolio overlap and mitigate risk. Like in the above portfolio, there are multiple small cap funds, and a couple of thematic and flexi cap funds.

Portfolio Overlap Analysis: Be cautious of portfolio overlap, where multiple funds hold similar stocks. This can reduce the benefits of diversification. Review the top holdings of your funds and avoid redundant investments in the same stocks through different funds. How to do that ?

Visit www.thefundoo.com/Tools/PortfolioOverlap

and check your overlap among different mutual funds or even ETF’s.

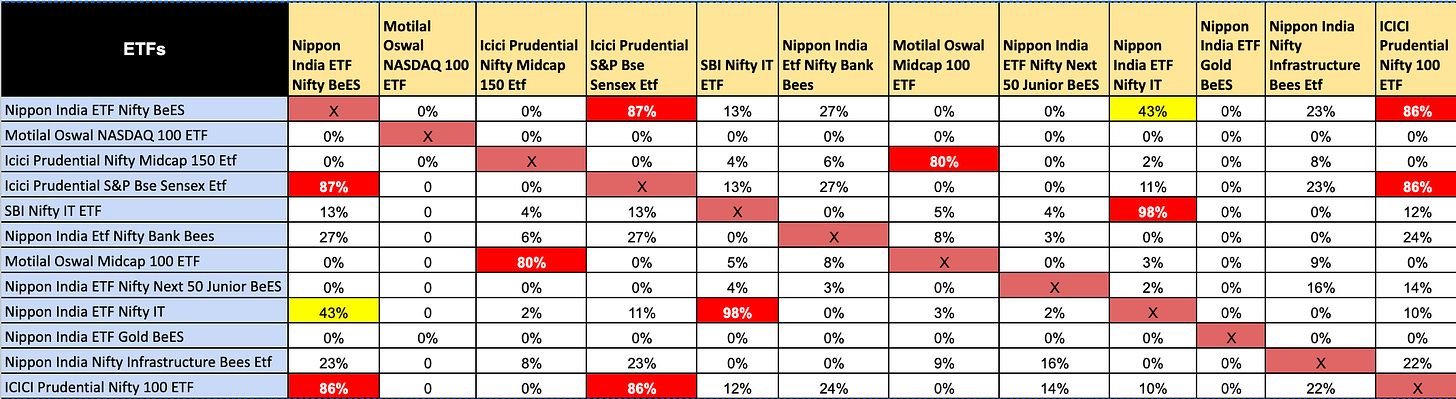

I had done this exercise around an year back on few of the ETFs I had in my portfolio. This helped in reducing and eliminating few of the ETFs where 3/4th of the portfolio is just replicated in any other ETF. You can use it here Fund Overlap Exercise

Exiting Sectoral and Thematic Funds: While sectoral and thematic funds might seem appealing, they can introduce concentration risk. These funds focus on specific sectors or themes, potentially leading to imbalanced portfolios. Instead, prioritize diversified funds that provide exposure to a broader range of assets.

When it comes to investment strategies, the appeal of sectoral and thematic funds might seem alluring. A thematic fund, for example, places bets on companies poised to capitalize on rising consumption trends. This theme, in turn, might span sectors like FMCG, consumer discretionary, auto, and banking, broadening its focus compared to a sectoral fund. However, as an astute investor, it's crucial to exercise caution when considering both sectoral and thematic funds.

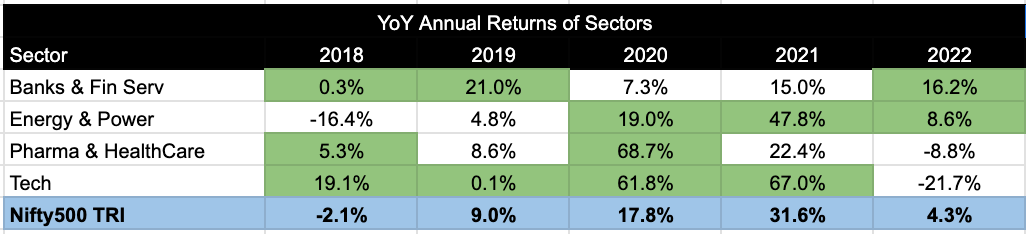

The primary concern with sectoral funds lies in their limited focus. If a particular sector experiences a downturn, investment returns could be adversely affected. Economic cycles are dynamic, and sectors that once reigned supreme can swiftly lose their luster. Refer to the table below, depicting sector performance against the Nifty 500. The green blocks indicate outperformance, while the white ones denote underperformance.

Its a similar story for thematic funds.

Predicting which sector or theme will thrive in the future is a daunting task, even for seasoned investors. Fortunately, as a mutual fund investor, one is spared of this predicament. Fund managers bear the responsibility of deploying assets into appropriate sectors or themes.

This brings us to a crucial recommendation: consider exiting sectoral and thematic funds in your portfolio, and instead, focus your attention on diversified options.

Debt Funds : Their role in a well-rounded investment strategy should not be underestimated. These funds serve short-term goals and contribute a debt component to your portfolio, facilitating seamless rebalancing. It's not uncommon for investors to hold more debt funds than necessary, inadvertently complicating their investment mix. Opting for a combination of short and liquid duration funds usually suffices for most purposes.

Remember, while exploring debt funds, avoid those high on credit risk or duration risk. Such funds introduce unwarranted volatility. Keep in mind that debt investments prioritize the return of principle, not the return on principle. Therefore, resist the urge to chase returns within the debt fund realm and refrain from cluttering your portfolio with an excess of debt options.

As I bring this post to a close, we shall reflect on the importance of managing and cleaning up our investment portfolios.

By employing the strategies and insights shared in this post, one can simplify her/his investments and make way for more rewarding opportunities. An efficiently managed investment portfolio is a cornerstone of successful wealth-building. Rather than accumulating a large number of funds, we should focus on a purposeful and streamlined approach. Understanding the allocation of each fund, exiting underperformers, and comparing and consolidating redundant funds is the key for a well balanced portfolio. We shall avoid excessive portfolio overlap and consider the risks of sectoral and thematic funds. By following these strategies, one can optimize her/his investment portfolio for better returns, reduced risk, and easier management.

As I understand, it's not about quantity; it's about the quality and purposefulness of our investments. We need to take charge of our financial future today, and leverage tools to check and identify any red flags along the way. We shall prepare ourselves to unlock the simplicity, efficiency, and profitability that comes with mastering the art of simplifying our investment portfolio.

Summarising :

📈 Having excessive funds in your portfolio can hinder returns and diversification.

🔄 Regularly chasing performance, excitement, mis-selling, and lock-in periods lead to over-accumulation of funds.

⬇️ Reduce fund count to enhance portfolio management, increase returns, and prevent over-diversification.

🌐 Three main reasons to limit funds: easier management, improved returns, and preventing excessive diversification.

📊 Too many funds can dilute returns; example shows fewer funds outperforming a larger fund count.

📌 Rule: Keep as few funds as possible; a well-diversified portfolio requires minimal funds.

💼 Allocate purposefully, exit underperformers, utilize fund rankings, and consider tax implications.

🚀 Strategy: Eliminate redundant funds to decrease overlap and optimize diversification.

🔀 Exit sectoral and thematic funds for a more balanced and diversified portfolio.

🔍 Regularly review and rebalance your portfolio to ensure optimal fund selection and allocation.