Unlocking the World of NPS: Demystifying NPS as a Market-Linked Retirement Solution

A Comprehensive Guide to the National Pension System in India

In a world teeming with retirement solutions, the National Pension System (NPS) stands as a formidable contender, offering a versatile and personalised approach to securing your financial future.

Its a 3-part series providing a holistic view of the NPS, covering all its key aspects comprehensively. Feel free to refer back to any section as needed.

Post 1: Background and Basics (this)

Post 2: Choices, Returns and Taxation

Post 3: Withdrawals and Annuities

In this post, we unravel the basic nuances of NPS, equipping you with the knowledge you need for a financially secure retirement.

Let’s go !!!!

The National Pension System (NPS) is a robust and flexible retirement savings scheme, meticulously overseen by the Pension Fund Regulatory and Development Authority (PFRDA). Here's a concise breakdown of this financial avenue:

PFRDA: The Guardian of NPS

PFRDA, formed initially in 2003 and later solidified by the PFRDA Act 2013, is the statutory authority regulating the pension sector in India. Just like Insurance is regulated by IRDA, Banks and NBFCs by RBI, similarly NPS is regulated by PFRDA.

NPS: The Background

Government backed: NPS was introduced by the Central Government to help the individuals have income in the form of pension to take care of their retirement needs.

No employment restrictions: Its a defined contribution scheme. Anyone can choose this as retirement solution irrespective of their employment.

Market Linked Product: It’s a market-linked defined contribution scheme that helps you save for your retirement. The scheme is simple, voluntary, portable and flexible.

Save Tax: It is one of the most efficient ways of boosting your retirement income and saving tax.

PRAN: Your Pension Identity

Eligible NPS subscribers receive a unique 12-digit Permanent Retirement Account Number (PRAN), serving as a consolidated record of all NPS activities, whether in the government, private sector, or self-employment. Something like this.👇🏽

NPS Mechanics: Contributory & Market-Linked

NPS functions as a contributory pension system, where subscribers (individuals like you and me) save over their working years to build a corpus. One will, let’s say, invest Rs 5000 monthly towards his/her fund over years (eg. Age 30-60). We will talk about how this amount is withdrawn and all the nuances.

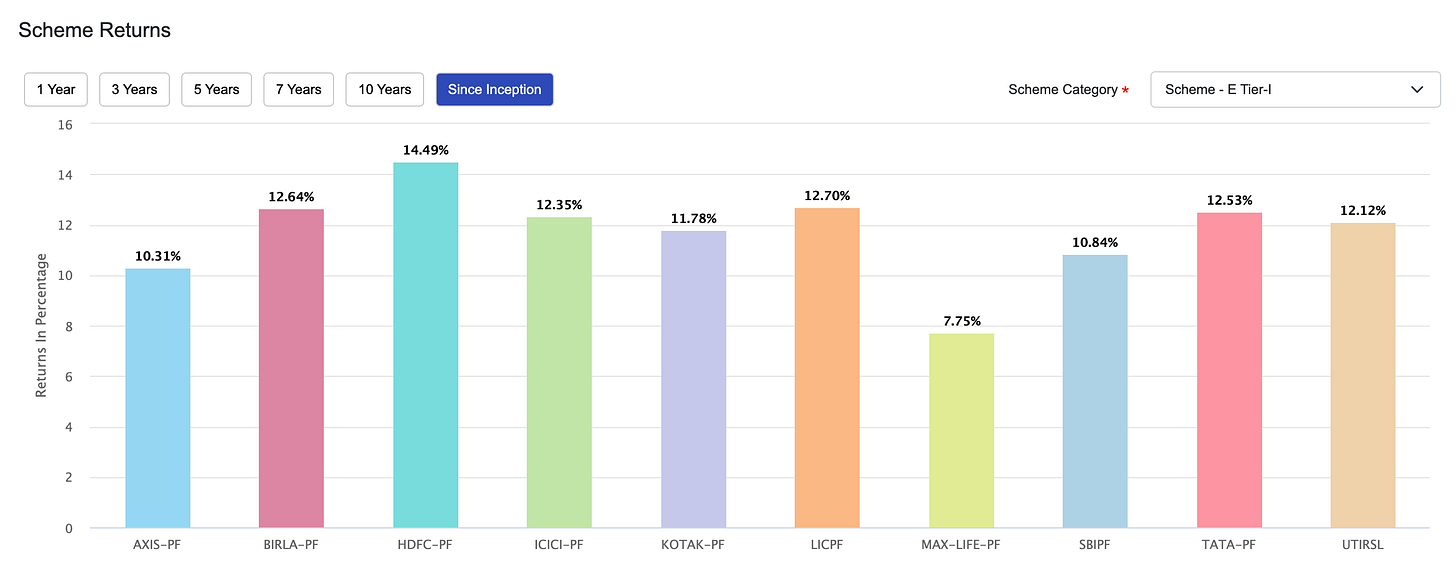

Subscribers, invest in NPS funds of their choice, linked to expected risk and returns. Different pension management funds alongwith their returns like Kotak PF, UTI, HDFC PF, AXIS PF, LIC PF etc are shown below. One can choose any of the fund house and start investing in them.👇🏽

NPS operates in the market, offering market-linked returns, with the pension payout relying on the accumulated corpus's ability to purchase an annuity at retirement.

Pooling Funds for Growth

NPS works like Mutual funds where NPS pension funds (like HDFC PF etc.) combine contributions from multiple subscribers/individuals, invest them as per fund objectives, and adhere to regulatory guidelines defined by PFRDA. (Mutual funds are regulated by SEBI).

These funds are managed by appointed fund managers, ensuring your money is in capable hands.

Over time, contributions and returns accumulate in individual pension accounts, creating a retirement corpus that grows with time, thanks to the magic of compounding.

For an investor like me and you, it would be a replica of what is done in mutual funds while investing. But you will have to make certain choices which we will understand in this series.

Personalization and Flexibility

NPS empowers subscribers to make important choices:

Determine the contribution amount (except in government models which has a prescribed minimum amount).

Define the contribution period. Can be extended beyond 60 as well.

Select investment funds & Choose fund managers. As on date, there are 10 fund managers e.g. UTI,Kotak,HDFC,Axis etc.

Monitor fund performance and switch based on preferences.

Eligibility

The eligibility criteria to open an NPS account requires:

You are eligible to open your NPS account if you are a citizen of India whether resident, non-resident, if you fulfil the following conditions:

You should be between 18 and 70 years of age,

You need to comply with the Know Your Customer (KYC) norms.

One must contribute a minimum of Rs 1,000 per annum and Rs 500 per contribution.

NPS is an individual pension account and cannot be opened on behalf of a third person.

One can still contribute to NPS even if she/he is NRI.

In case, you work for any corporate and the corporate has adopted the NPS scheme, you can choose to open account/ shift account with them. This will be helpful in reducing your taxable income (here!).

To delve deeper into the choices, intricacies of NPS, the tax implications, investment strategies, and finally the choices across redemption ,be sure to check out our second and third post in this series, where we explore these aspects in more detail.