Unlocking the World of NPS: Demystifying NPS as a Market-Linked Retirement Solution

Redeeming Your Accumulated Wealth

In our exploration of the National Pension System (NPS), we've delved into its fundamentals (part 1), eligibility, diverse account types, schemes. We've understood the options available in asset classes, scrutinized the historical returns of NPS (part 2), and demystified the tax implications surrounding the investments.

Now, as we progress in this final financial voyage, it's time to unravel the critical phase when we decide to reclaim our diligently accumulated funds after years of compounding. Let's dive into the intricacies of redeeming our hard-earned money, understanding the pivotal steps involved in this culminating phase of NPS journey.

Redemption and Withdrawals

Individuals can withdraw/redeem this locked- in pension corpus only at the age of 60 or retirement with some exceptions. The investor can also choose to defer withdrawal until 75 and stay invested in the NPS scheme if preferred.

Let's break down the withdrawal options into three distinct segments:

Retirement/ Maturity/ Superannuation/ Age=60

Partial Withdrawal

Premature Exit

The NPS withdrawal rules mentioned above are applicable only to a Tier I account. There is no withdrawal rule for a Tier II account. An investor can withdraw any amount from a Tier II account as per their requirement.

A) NPS Withdrawal After Maturity (At age 60)

Redemption is done in 2 segments:

Right now, If you're not inclined to delve into the intricacies of the other two withdrawal mechanisms, let's move to exploring the taxation aspects associated with NPS withdrawals (1 page down).

B) Partial Withdrawal

Following are the conditions of partial Withdrawal:

Although, NPS is a long term view and its better to keep it untouched but in case required, understanding these conditions empowers one to navigate the landscape of conditional withdrawals judiciously, ensuring that financial decisions align with their broader life goals and requirements.

C) Premature Exits

In the realm of NPS investments, should an investor decide to make an early exit and withdraw their funds before reaching the age of 60, the PFRDA does allow for such withdrawals, subject to certain stipulations.

Investors can opt for a premature exit (before ag 60), however, this option is available only after 5 years of investment. In case of pre-mature exit, pension starts immediately. The rules are as follows:

These were the withdrawal scenarios and now lets move on to the taxation on these withdrawals.

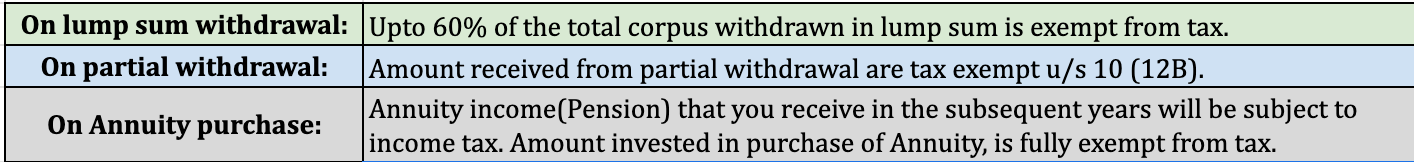

Taxation on Withdrawals

Apart from tax benefits available under 80CCD, below are the other tax benefits available under NPS:

For example:

Suppose your total corpus at exit, say at the age of 60, amounts to 50 lakhs. Withdrawing 60% of the total corpus, i.e., 30 lakhs, as a lump sum wouldn’t incur any tax liability. Opting to allocate the remaining 40% for annuity purchase (20 lakhs) allows one to sidestep immediate taxation.

The tax implications only kick in on the subsequent annuity income (Pension income), taxed as per your applicable income tax slab.

Important Timeframes for NPS Withdrawal

When considering NPS withdrawals, summing up the time periods to keep in mind as per current NPS rules and regulations:

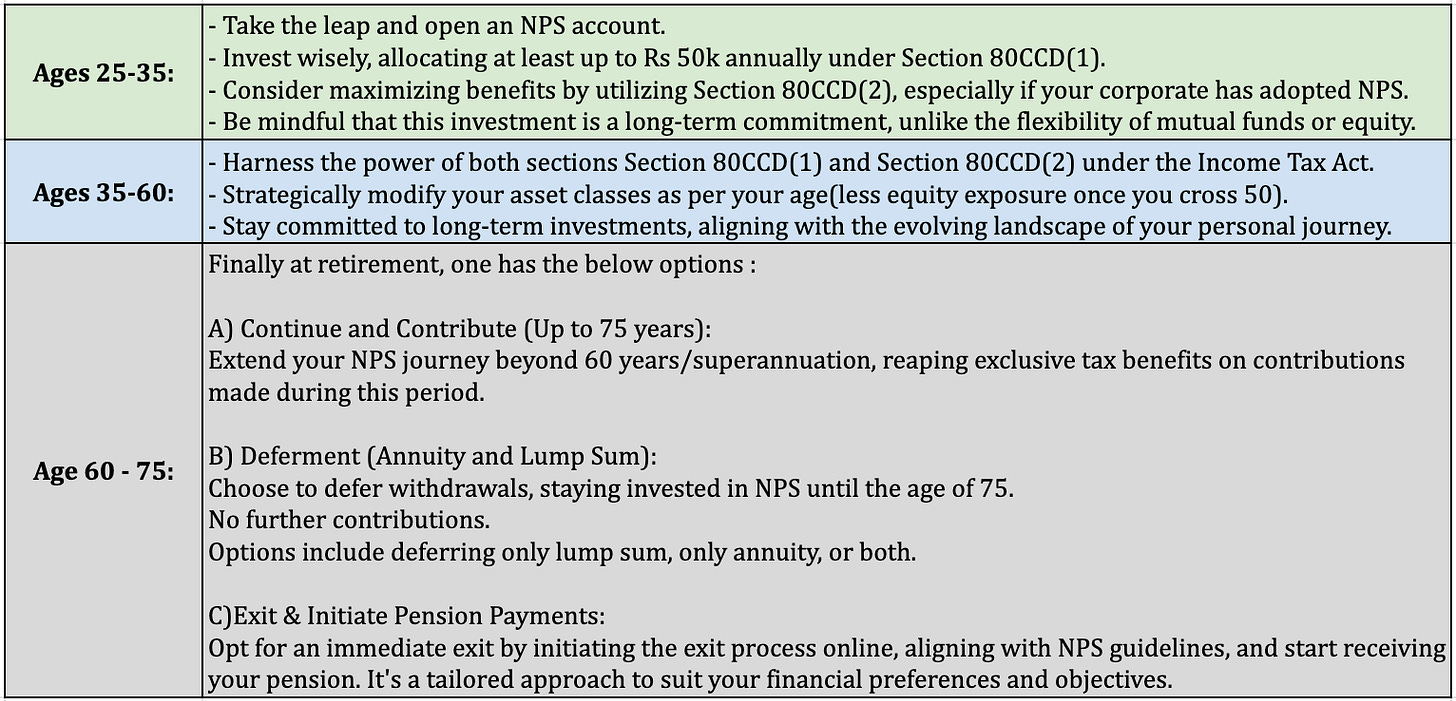

Actionable at certain Ages

Tailor your actions as per your age group.

Annuities: The final frontier

In the intricate landscape of the NPS, annuities play a pivotal role, representing the monthly sum disbursed to subscribers by the Annuity Service Provider (ASP). A strategic portion of the pension wealth, determined by subscribers, is allocated for the acquisition of annuities from authorized Annuity Service Providers.

Annuity Service Providers (ASPs): assume the crucial responsibility of delivering a consistent monthly pension to subscribers post their exit from the NPS.

These ASPs, essentially insurance companies regulated by the Insurance Regulatory and Development Authority (IRDA) and empanelled by the Pension Fund Regulatory and Development Authority (PFRDA), are entrusted with the task of furnishing annuity services to NPS subscribers.

Under the NPS umbrella, ASPs offer a spectrum of annuity schemes, each tailored to meet diverse subscriber needs:

Understanding the nuances of these annuity schemes empowers subscribers to make informed choices aligned with their unique financial objectives and future security.

Here is an example for different type of Annuities with Rates:

With this comprehensive exploration, we've delved into crucial facets and topics shaping your financial strategy.

Thank you for accompanying me on this insightful journey!

If this content has proven beneficial, share it within your world.

Your feedback and suggestions are always valued—feel free to reach out.

Until next time, may your financial path be paved with informed decisions and prosperity.

Additional Resources :

Charges - Major ones are below.

PRAN Opening charges - Rs 40

Annual PRA Maintenance cost per account - Rs 70

Charge per transaction - Rs 3.75

Investment Management Fee = 0.09%

Payment Gateway Service Charge => UPI & Debit Cards = Free

Payment Gateway Service Charge => Credit Card = Percentage (%) of transaction value

Payment Gateway Service Charge => Net Banking = Flat Rs 8/-

NPS Calculator - Goal based and Maturity Value based.

Annuities Example