Unlocking the World of NPS: Demystifying NPS as a Market-Linked Retirement Solution

Types of accounts, Choices, Returns and Taxation on Investments

So, in our last post, we read the basics of NPS, how the amount gets pooled and distributed, eligibility etc. Now we move towards more details which one shall understand before hurriedly taking decisions.

First let’s understand what are the different account types.

Types of Accounts

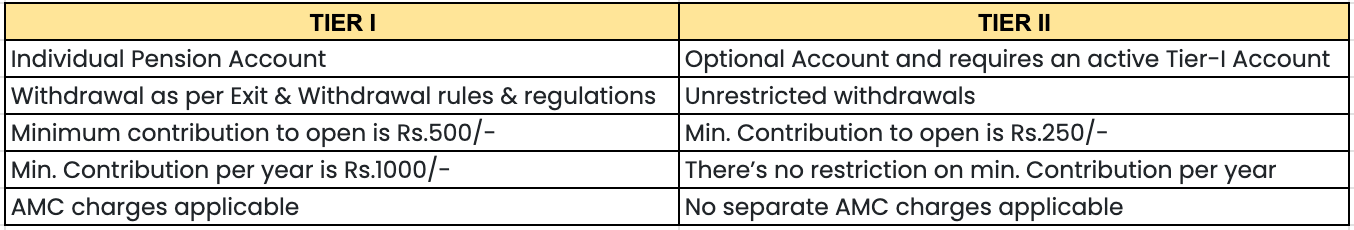

NPS provides you two types of accounts: Tier I and Tier II.

Tier I is mandatory and permanent retirement account into which the regular contributions made by the subscriber and/or their employer and are credited and invested as per the scheme/fund manager chosen by you whereas

Tier II is a voluntary/optional withdrawable account associated with your PRAN. Tier II offers greater flexibility in terms of withdrawal, unlike Tier I account, you can withdraw from your Tier II account at any point of time. In short, it works like any other mutual fund but can only be opened after opening of Tier I.

Operational Choices

Let's explore the two distinctive approaches NPS offers: Active Choice and Auto Choice, each tailored to suit your financial preferences.

Active Choice: Design Your Portfolio: In the realm of NPS, flexibility takes center stage with Active Choice. Craft your portfolio by allocating funds among four asset classes, each catering to a unique risk appetite:

Equity (E): A 'high return-high risk' fund primarily investing in the equity market.

Corporate Debt (C): A 'medium return-medium risk' fund centered around fixed-income bearing instruments.

Government Securities (G): A 'low return-low risk' fund exclusively invested in Government Securities.

Alternative Investment Funds (AIF): This asset class ventures into instruments like CMBS, MBS, REITS, AIFs, and Invlts.

So, if one invests Rs 10,000 in a month, Rs 7500 would go to Scheme E, Rs 2000 to Scheme C and Rs 500 to Scheme G

Auto Choice: Dynamic and Time-Saving For those seeking a more hands-off approach, Auto Choice dynamically allocates your portfolio based on your age. As you age, exposure to Equity and Corporate Debt gradually decreases, while exposure to Government Securities increases. Choose from three risk appetite options:

Aggressive (LC-75): Maximum Equity exposure of 75%

Moderate (LC-50): Maximum Equity exposure of 50%

Conservative (LC-25): Maximum Equity exposure of 25%.

Whether you prefer the creative control of Active Choice or the dynamic simplicity of Auto Choice, NPS empowers you to shape your financial future. For the conservative investor, allocate your pension wealth to C or G asset classes. Your financial journey, your rules.

So, lets say, a person aged 30-40 years of age, not a conservative investor, can choose - Tier I-Scheme E from any of the Pension Fund (HDFC/ KOTAK/ ICICI etc).

I would choose ‘Active’ as that would allow me maximum exposure to Equity, which in long run (next 25 years) will help to boost my returns.

Returns

Below is the scheme returns for 10 years (as on Nov’23) against the benchmark returns of 13.3%. You can also check the returns for different schemes for different time periods here.

You will also get the funds top 5 holdings along with the weightage for each PFM and each scheme here.

Taxation on Investments

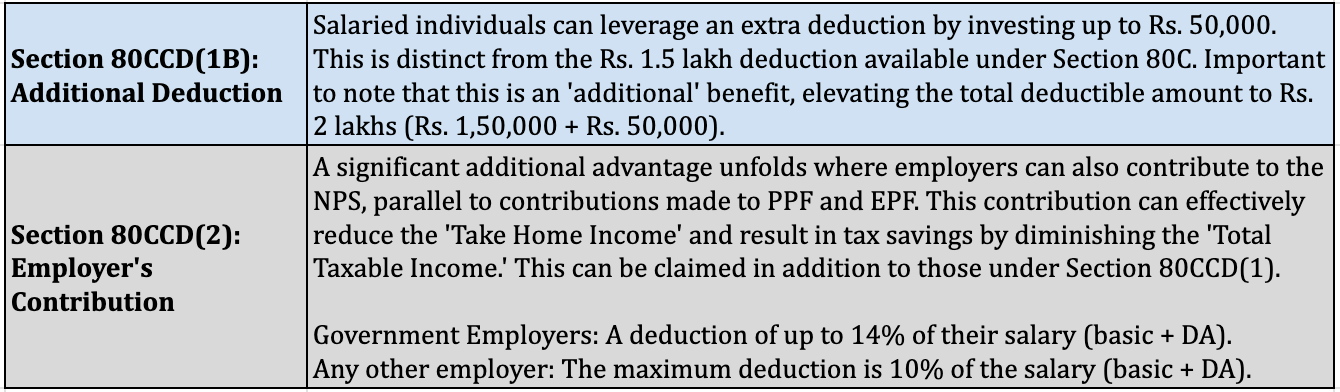

Transitioning to the next crucial aspect of taxation, let's unravel the intricacies of tax benefits within the National Pension System (NPS).

Tier I: Salaried individuals have two avenues to save on taxes.

Understanding and strategically utilizing these provisions can significantly enhance your tax planning.

Tier II : Has No Tax Benefits

Example: In this example, with the Section 80C deduction capped at Rs 1.5 lakhs you can observe how taxable income has come down to 11.5 lakhs from 13 lakhs allowing individuals to maximize their tax savings efficiently.

Tax Savings:

With 80CCD (2) + 80CCD(1) : Tax calculated on Rs 11,50,000.

With only 80CCD (1): Tax calculated on Rs 12,50,000.

With only 80C Investments : Tax calculated on Rs 13,00,000.

Having laid the foundation for informed choices in selecting the type of NPS accounts, let's now delve deeper into the intricacies of withdrawing the accumulated corpus. Join me in the next post as we unravel the nuances of NPS withdrawals,taxations and annuities. Stay tuned for a the last leg of exploration !

Disclaimer:- This is my own study and not an investment recommendation. Request you to please consult your own financial advisor before making any investment decisions.

So you suggest to go with NPS deduction through employer and by individual both? I have opened my NPS account by myself in HDFC but my employer is providing it through ICICI. Will there be any charge if I shift from HDFC to ICICI?