Hello All,

As we moved to final stage of Lok sabha elections, this week saw further consolidation as PSU stocks edged higher in anticipation of the penultimate week of elections.

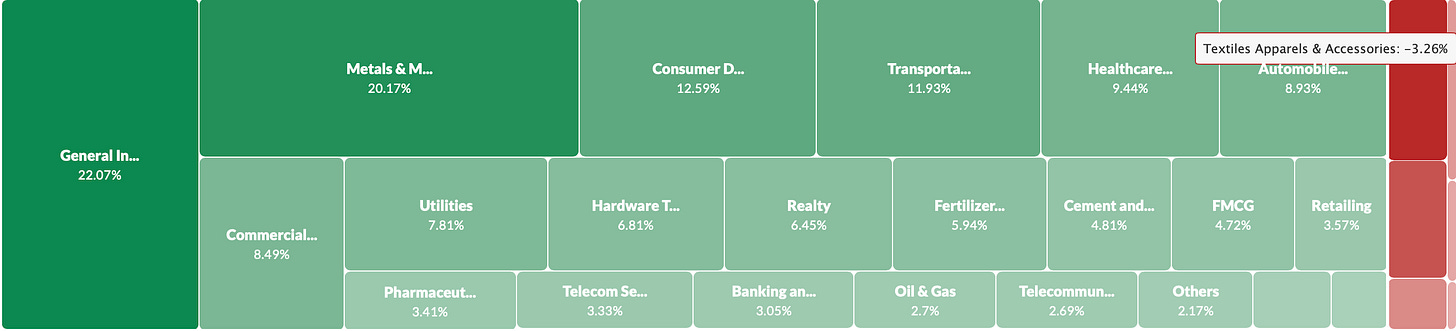

PSU stocks led the way with over a 4% return on the index, while small and micro caps underperformed. Noteworthy sectors included Metals, Commodities, Auto, and Energy.

Many auto ancillary companies are showing strength on the charts, driven by strong earnings results for most of them. Also, the PE of Nifty Smallcap100 is at 26.5. Over last month, Out of 100, only 15 stocks have gained more than 5% whereas 44 are down by more than 5%. Same number is 91 & 6 resopectively while we observe it over an year.

Let's find out what stories did the other numbers tell us last month. In case you are new here, the about page for our Newsletter is here

Now Lets Goooo !

How have the Sectors panned out last month ?

At the Top - General Industrials

Top 3 Gainers from ( >500cr Mcap & > 5% Monthly Change)

How to read this ?

For 5Y, returns are max for S&P Industrials at 359% (Greenest) and min for Nifty Media at -15% (Red). Similarly, one can check for each time period. The table is sorted by 5Y returns.

Nifty 50 Returns over last month

Out of 50, 42 stocks gave >5% returns in last 1 year and 34 gave >5% in last 6 months.

→ In last 1 year, 29 have beaten the Nifty 50 returns (25.3%).

→ Only 3 out of 50, gave >100% returns in last 1 year. (NTPC,Coal India & MnM).

→ While 8 companies gave negative returns in last 1 year. These are

Kotak (-12%), HDFC BANK (-6%), Asian Paints (-8%), HUL (-9%),

HDFC LI (-1%) , LTI Mindtree (-1.4%), ITC (-1.1%) & Bajaj Finance (-0.1%)

The Current PE = 21.9

Avg PE at different time periods are :

1M = 21.68 ; 3M = 22.46 ; 6M = 22.6

1Y = 22.3 ; 2Y = 21.6 ; 5Y = 25.6

Stocks Touching 10 year high !

"Stocks Touching 10-Year High" signifies that a stock has reached its highest price level in the past decade. This indicates long-term strong performance and positive market sentiment. It suggests robust business growth and investor confidence, potentially attracting more interest and indicating sustained upward momentum. However, it may also prompt caution regarding overvaluation. There can be others also which might be not part of the list but sharing here only those which have good ROCE/ROE/OPM/Revenue growth and also not overvalued.

Top Monthly Gainers

Great momentum stocks indicating strong short-term and medium-term performance, driven by positive news, earnings reports, or market trends. Do note the valuations of the stocks!

Highest Volume Stocks with Good fundamentals :

These are stocks with their End of day BSE+NSE delivery volume trading 2 times of Avg Month NSE+BSE Delivery volume. Volume Multiplier is ratio of delivery of Volume at the end of the day to Average delivery volume for the Month. This indicates

- a surge in investor interest or trading activity.

- increased volatility (Opportunity for Short term).

- speculative risk.

- Improved liquidity.

It's important to note that while increased delivery volume can be a sign of significant market interest, it does not guarantee that the stock will perform well (upside/downside) in the future.

Traders and investors should consider various other factors, such as company fundamentals, market conditions, and their own investment objectives, before making decisions based solely on trading volume data. Additionally, past performance is not indicative of future results, so thorough research and risk management are essential in any strategy.

These are not recommendations to buy or sell !!

Back testing

Now, lets see the back test of this strategy over a different periods. The stock selection means that the stocks being selected are either from Nifty 50 or Nifty 500.

Tried out rebalancing of such selected stocks on a different frequencies like monthly or quarterly so that we give the stock a change to perform over such periods and then compare and then do the selection/deselection of the portfolio. Also, to compare the returns, have selected the benchmark performance as Nifty 50/500.

The above comparison gives the strategy 2 as the best strategy keeping quarterly as the best refresh and Nifty 500 as the optimum pool for stock selection. I have checked returns of Nifty 50 as well (Strategy 3) and the benchmark returns have dropped from 281% to 241%.

As per this strategy, if the rebalancing is reduced to Monthly (Strategy 1) the returns drop significantly.

If we limit the stock selection to Nifty 50 (Strategy 4), the strategy returns drop to a meagre 107% which is below par the Nifty50 CAGR.

Stocks At 52 Week High

Stocks at 52-Week High indicates that a stock has reached its highest price in the past year, reflecting strong performance and positive market sentiment. This milestone can signal upward momentum but may also suggest potential overvaluation. Investors often watch these stocks for further gains or reassess their strategies based on this performance indicator. For some traders, a stock hitting a 52-week high might signal a breakout, suggesting that the stock could continue to rise if it surpasses previous resistance levels.

All time high Stocks are important to track and how they have historically provided returns is shown below.

I have taken a period of 5 years to back test this and compared the returns with Nifty500 Benchmark.

Thanks for reading The Curious Investor ! Did you like the insight on back testing over different benchmarks and rebalancing ?Subscribe for free to receive new posts and support my work.

Stocks with estimated High Bullishness from Analysts

Last month lot of analysts were only bullish on HDFC Bank and ICICI Bank. This week we observe addition of AXIS and IndusInd also joining in. Lot of Banks, SFBs and Microfinance Institutions.

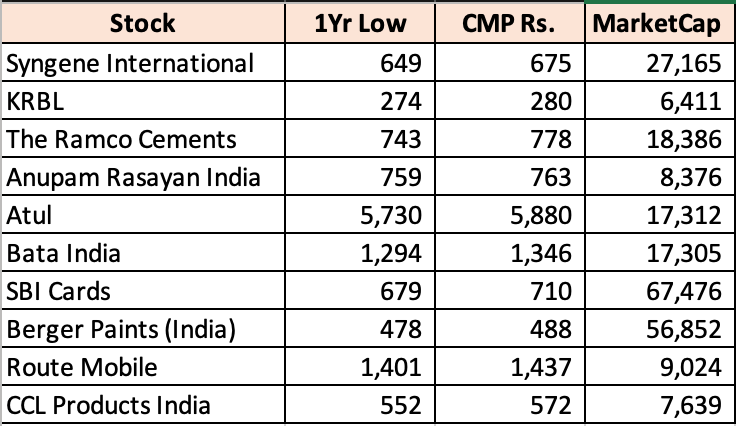

Leaders with Current Price below 200Day DMA

In technical analysis, the 200-day DMA is a long-term trend indicator. When the current price is below this level, it might signal a bearish trend or a downturn. While other aspect is that these leading stocks may be temporarily undervalued, presenting a potential buying opportunity for investors who believe the stock will revert to its mean or rise above the 200-day DMA again especially where the valuations are sane.

Near 52 Week Low

5 Interesting Stocks

Paras Defence

ISGEC

Netweb Technologies

Oberoi Realty

Alicon Castalloy

Thanks for reading till now. I hope these 5-7 mins have added some value in your analysis.

Thanks,

Curious Investor

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as investment advice. The analysis and insights presented are based on publicly available information, and while efforts have been made to ensure accuracy, we cannot guarantee the completeness or reliability of the information.

Investing in securities carries inherent risks. This post should not be relied upon as a substitute for independent research or consultation with a qualified financial advisor.

The author of this post and the platform on which it is published do not provide personalized investment recommendations or financial advisory services. Any investment or trading decisions you make based on the information provided in this post are solely at your own risk.

Neither the author nor the platform shall be held responsible or liable for any loss or damage arising directly or indirectly from the use of or reliance on the information contained in this post. Readers are encouraged to conduct their own due diligence and seek professional advice before making any investment decisions.

By accessing and reading this post, you acknowledge and agree to the terms and conditions outlined in this disclaimer.

Other Articles

Selective Spectrum - Here I share the best podcasts/videos/articles across Business, General Knowledge, Health, Productivity and many more ! Dont Miss Out !