In today's volatile financial landscape, it's crucial for investors to diversify their portfolios effectively. Here we try to highlight the importance of gold as a critical component of a well-diversified long-term portfolio. It emphasizes that gold isn't just an alternative asset; it’s a strategic hedge against market instability and economic uncertainty.

Gold has been a traditional store of value for centuries, particularly in India. It is considered as one of the safest assets, especially during periods of economic uncertainty or inflation. Unlike stocks, which represent ownership in a company, gold is a physical commodity whose value is largely driven by global demand, currency fluctuations, and geopolitical stability.

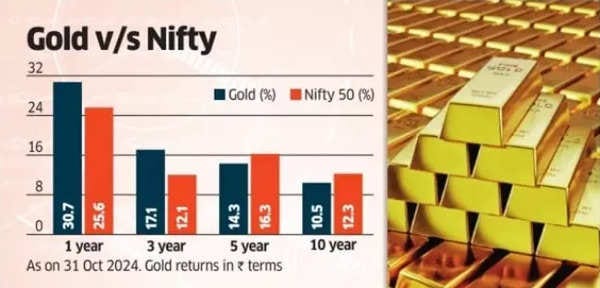

Comparative Returns

The Inverse Relationship Between Gold and Equities

A core concept here is the inverse relationship between gold and equities. When stock markets decline, gold prices often rise. This makes gold a valuable tool for balancing a portfolio. When equities are struggling, gold tends to thrive, offering a safety net for your investments.

Gold as a Safe-Haven Asset During Economic Turmoil

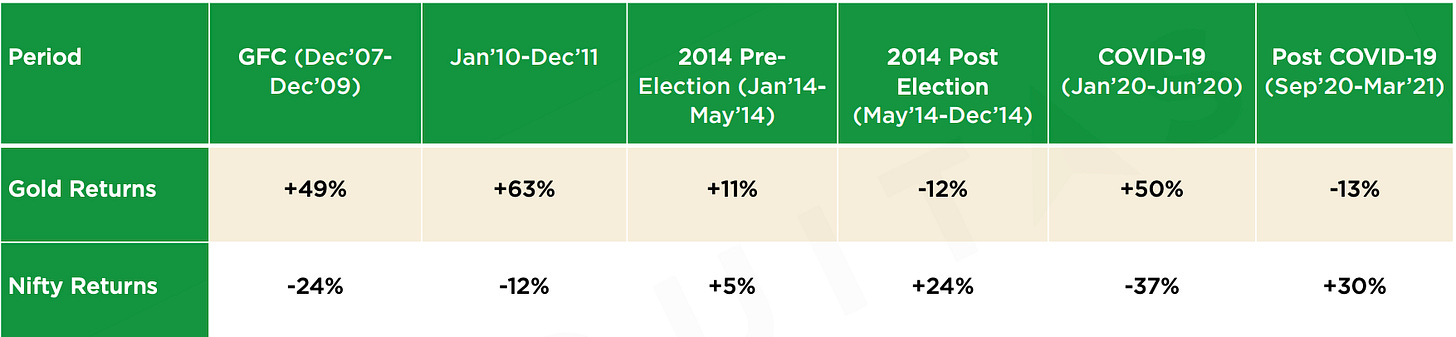

Lets see Gold's performance during various periods of economic uncertainty:

Global Financial Crisis (2008): During the 2008 subprime mortgage crisis, gold appreciated by 49%, while the Nifty fell by 24%. This shows gold’s role as a dependable asset that provides stability and safeguards wealth during economic turmoil.

During the 2008 global financial crisis, gold significantly outperformed the Nifty50. Specifically from December 2007 to May 2009, gold appreciated by 49%, while the Nifty fell by 24% This means gold delivered an alpha of 73% over the index.

This performance highlights gold's role as a reliable asset that provides stability and safeguards wealth during economic turmoil. The data shows that, during the 2008 financial crisis, investors moved towards gold as a safe-haven asset, while equities experienced significant losses.

Market Volatility (2010-2011): Amidst the European debt crisis and U.S. credit concerns, gold soared by 63% while the Nifty declined by 12%.

Pre-election uncertainty (2014): From January to May 2014, before the Indian general elections, gold increased by 11%, while the Nifty saw a modest 5% gain.

COVID-19 Pandemic: During the initial phase of the pandemic, from January to April 2020, gold surged by 14% as the Nifty plummeted by 38%. Below chart is from Dec 2019 (just befor covid) till May2021. You can see almost no volatility in Gold (Blue) whereas Nifty 50 (Red) took around 14 months to surpass returns made by gold.

These examples demonstrate gold's ability to act as a safe-haven during economic downturns, providing a crucial hedge against losses in equities. Equities give investors the opportunity to benefit from a country's economic growth. Gold, on the other hand, is valued for its ability to store wealth and protect purchasing power.

Gold's Performance During Market Recovery

When markets recover, equities tend to outperform gold. For example:

Post-election rally (2014): Following the 2014 general election, when investor confidence surged, the Nifty rose by 24%, while gold dipped by 12%.

COVID-19 recovery (2020-2021): As markets recovered after September 2020, the Nifty rebounded by 30%, while gold corrected by 13%.

This hints that investors might be shifting their funds back to equities as the market stabilizes and begins to grow.

Conclusion: Why Gold Now?

Central Banks and Gold

Central banks are increasing their gold reserves to hedge against fiat currency risks. This reinforces gold's role as a superior store of value and further enhances its attractiveness as an investment.

Gold as a Diversification Tool

Given its historical performance and inverse relationship with equities, gold is a compelling diversification tool. It is especially valuable when equity markets are volatile. Gold can provide a balance to a portfolio that is vulnerable to market downturns.

Long-Term Trends

From May 2007 to July 2024, gold has consistently outperformed equities during economic downturns, while keeping pace with the Nifty in the long run. This long-term performance highlights gold's potential as a dependable asset.

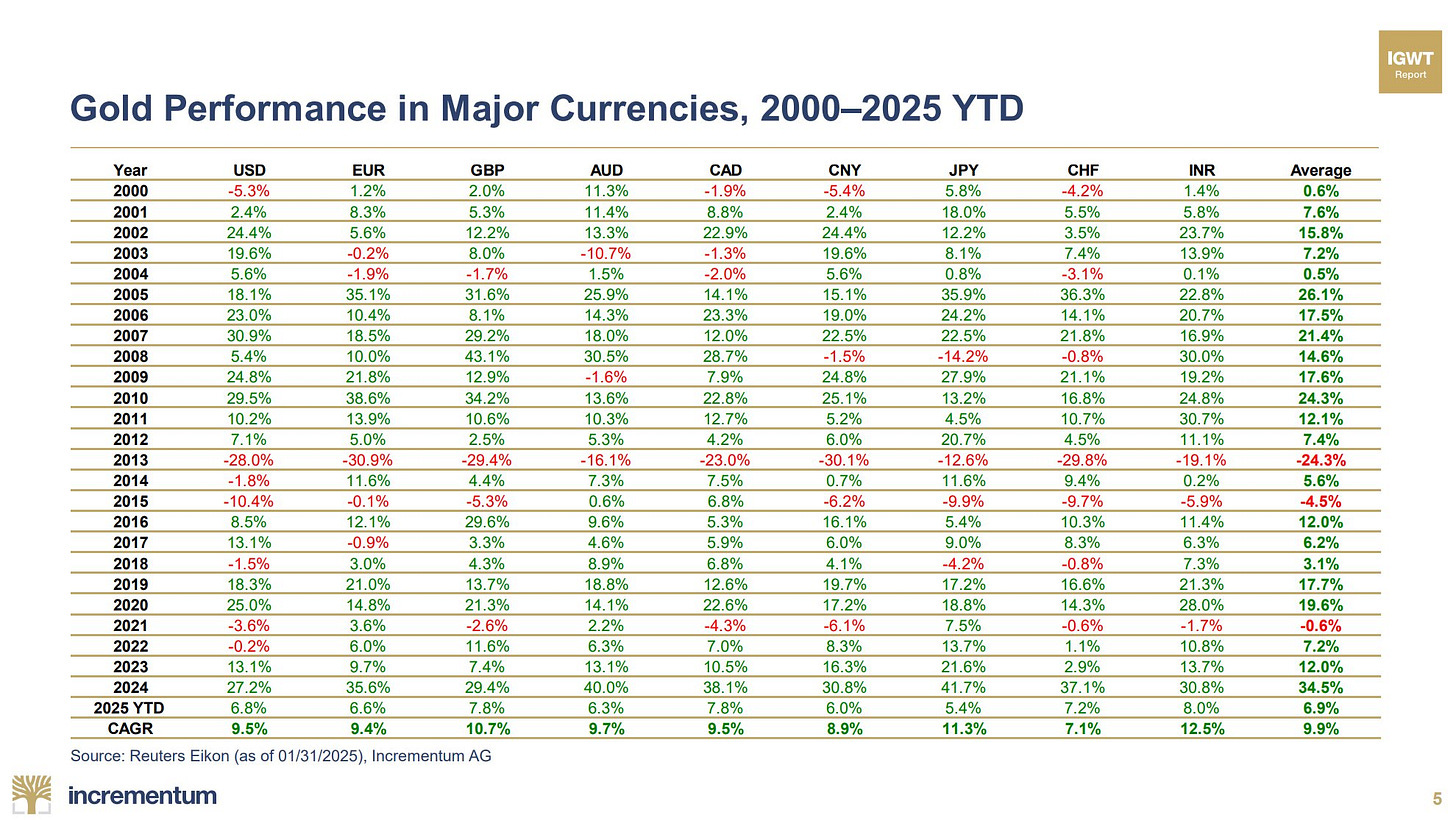

As we move into 2025, gold remains an attractive investment due to factors such as:

Frothy equity valuations across multiple indexes

Geopolitical tensions

Economic uncertainties amplified by inflation and currency volatility

These factors position gold as a critical hedge against market instability. Therefore, including gold in your investment strategy is not just about diversifying your portfolio; it’s about protecting your investments during uncertain times.

By understanding these insights, one can make informed decisions about integrating gold into your long-term investment strategy, ensuring a more robust and resilient portfolio. In our next blog, we’ll explore the different ways to invest in gold, from physical assets to ETFs and sovereign gold bonds, helping you make the right choice for your portfolio. Stay tuned!

Thanks!

Other Articles

Book Summary : 📚Outlive: The Science and Art of Longevity

Credits

Aequitas PMS

TradingView

TOI - Snapshot