In 2016, Brazil’s stock market soared over 40%, stunning global investors. Just a few years earlier, it had been one of the worst-performing markets. Fast forward to 2018—Brazil outperformed again, even as Hong Kong plunged more than 15%. In 2020 and 2021, it was India’s turn to shine, while traditional leaders like the UK and China stumbled.

Over the past decade, this pattern has played out again and again. No single country dominates for long. The leader one year is often the laggard the next. Investors who chased past winners often found themselves stuck in underperforming markets.

What if, instead of trying to predict the next top performer, you embraced the chaos—and diversified across it?

In investing, we often look for consistent outperformers — companies, sectors, or geographies that can be the "anchor" of a portfolio. But here’s the problem: no country holds the crown forever.

This post explores how diversifying across global markets can improve both your portfolio’s resilience and return potential — backed by 11 years of performance data and a striking heatmap.

📊 The Data: 11 Years of Market Rotation

Let’s start with this annotated heatmap — it shows the top 3 performing global equity markets for each year from 2015 to 2025, ranked by annual returns:

How to Read It: Each row is one of the top 3 global markets in a given year. The cells show Country (Annual Return %). Green = Strong years; Red = Weak years, even among top 3.

Source: ET Wealth

🔍 What This Chart Tells Us

Even without the visual, our data paints a clear picture. Notice how the top performers shift year after year. No single country consistently dominates. This constant rotation is a powerful argument for diversification. While India's Nifty 50 showed impressive growth in 2020 and 2021, it wasn't always at the forefront. Similarly, Brazil's Bovespa, despite its stellar years, also experienced periods of lower performance. This inherent variability underscores the wisdom of spreading your investments across different geographies to capture potential gains wherever they may emerge.

No One Country Leads Consistently

Brazil topped in 2016 with a massive +42.9%, but faded quickly.

India showed up six times in the top 3 — but never two years in a row.

Even the mighty US was absent from the podium in several years.

This tells us a simple truth: market leadership rotates. And it rotates fast.

📌 Who Wins, Who Wobbles?

We crunched the numbers across this 10-year span to count how often countries appeared in the top and bottom 3 globally:

Observations:

Brazil and India had the most top 3 appearances — but not without volatility.

China and Hong Kong consistently landed in the bottom 3 in recent years.

The US is surprisingly balanced — few big wins, but also few major losses.

UK and Mexico struggled to break into top tier returns.

If you were overly exposed to underperformers like China or the UK, your portfolio likely suffered — even during global bull runs.

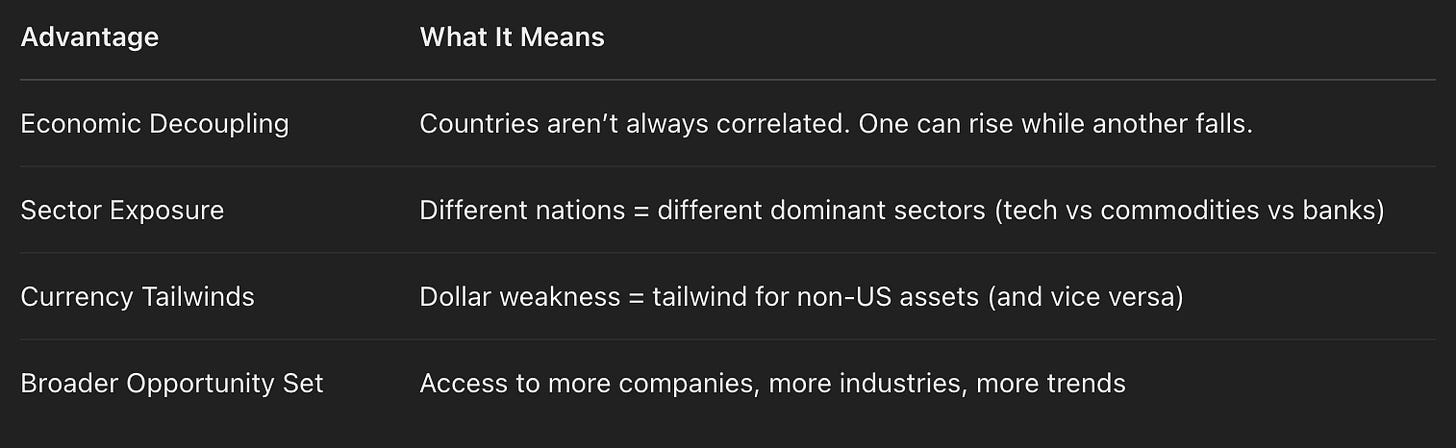

Why Global Diversification Works

A World of Opportunities: Navigating Diverse Markets

The global investment arena is a fascinating tapestry, with each market offering its own unique flavor and potential:

The Steady Hands: Developed Markets: These markets, like the USA (NYSE Composite), Japan (Topix), Germany (DAX), and the UK (FTSE 100), are generally characterized by stable economies, robust regulations, and mature financial systems. While they might not always offer the highest growth rates, they often provide a more predictable and less volatile investment environment.

The Engines of Tomorrow: Emerging Markets: Think of countries like Brazil (Bovespa), India (Nifty 50), China (SSE Composite), and Mexico (MXSE IPC). These economies are on a rapid growth trajectory, offering the potential for higher returns, albeit with a side of increased volatility and political considerations.

Markets Don’t Move Together: Brazil was the best performer in 2016 and 2018—while Hong Kong lagged. Global markets rise and fall at different times, helping balance your portfolio's ups and downs.

Sectoral & Thematic Exposure: Japan dominates in autos and tech, Brazil in commodities, the U.S. in innovation. Diversifying globally unlocks industries you can’t always access locally.

Currency Cushion: If your home currency weakens, gains in stronger currencies can offset losses. It's a built-in hedge against currency risk.

The Frontier: Where High Risk Meets High Reward: While not always topping our performance charts, frontier markets represent the next stage of developing economies. They offer the tantalizing prospect of significant growth but come with the highest levels of risk and require a deep understanding of their specific dynamics.

The data vividly demonstrates the ever-changing leadership in global markets. The top-performing index isn't a constant; it shifts and evolves year after year. Japan's Topix shone in 2015, while Brazil's Bovespa took the crown in 2016. This dynamic landscape underscores a fundamental truth: putting all your faith (and capital) in a single market is a risky proposition.

⚠️ Risks to Be Aware Of

Foreign exchange fluctuations can amplify or mute returns.

Political and regulatory risks vary widely (especially in EMs).

Liquidity and access — not all markets are easily accessible to retail investors.

Fees and taxation — cross-border investing may come with added costs.

These are manageable via:

Global ETFs and index funds

International mutual funds

Professionally managed multi-asset strategies

Hypothetical Strategy: A Simple Global Rotation Model

What if you invested in the

You wouldn’t win every year.

But you’d never be stuck in the worst performers either.

And over time, you’d have caught several mega rallies across geographies.

That’s the case for global diversification in action.

🎯 Final Thought: Let the World Work for You

“The most important thing about an investment philosophy is that you have one you can stick with.” – Seth Klarman

💬 What Do You Think?

Are you globally diversified? Do you lean heavily into one country or prefer global ETFs? 👇 Drop a comment — I’d love to know your approach.